Second Blog Entry – Funding Realities

With the onset of the fall academic season, great anticipation (and sometimes anxiety) rests with the status of student enrollment. Education of course has substantial and diverse societal benefits; however, in the realm of financial practicality and availability of resources, we cannot escape the funding dynamics associated with student enrollment and support for student learning.

As all State community Colleges, Barton receives funding through 4 primary streams of contribution. As of the end of FY2019, the breakdown is as follows:

- Tuition/Fees (40.3%)

- Barton County – local taxes (28.2%)

- State of Kansas – State Aid (25.5%)

- Misc. - Other Taxes and Other (6.1%)

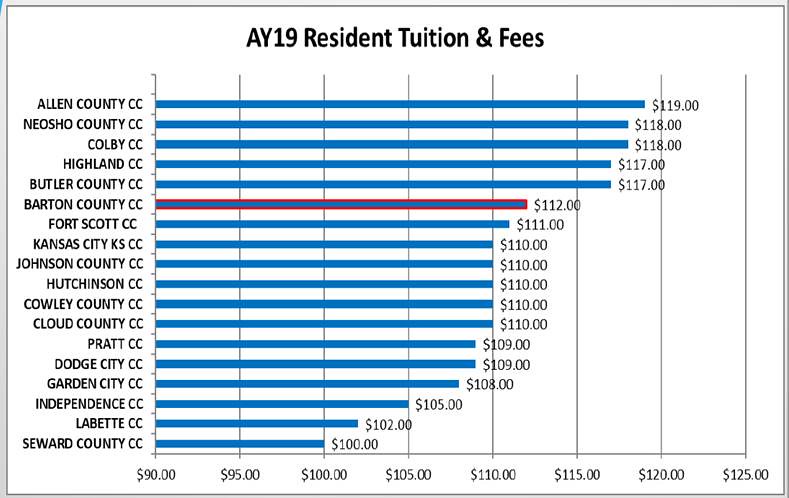

To remain competitive in the higher education two-year sector market, limiting the rise in tuition/fees is critical and that you not “out cost” your services as compared to the competitive market. As we ended FY2019, Barton was in the upper third tier of the 19 community colleges serving Kansas when comparing tuition and fees. See below.

As per local taxes and the College’s impact on the mill levy, Barton remains sensitive to limiting the tax burden on our local constituents. In the below graph, you see the Mill Levy history and that the College Trustees have not formally increased the Mill Levy since 2007. The varying Mill Levy rates that are posted in the graph are due to final County valuation that is determined after the College finalizes it fiscal year budget. With the mill remaining at 33.330 for FY19, it has been 12 years since the Barton Trustees approved an increase in the Mill Levy. For FY2020, Trustees have acted on a .430 reduction in the mill levy. Therefore, we have 13 years of not increasing the mill levy. The College, has benefitted however, in the increased valuation of County taxable resources over the years. For most years valuation has increased, but there have been years where there have been substantial decreases. The College has chosen to make due with County funding that accompanies the unchanging Mill Levy. By not increasing the Mill Levy, the priority emphasis has been to lessen the tax burden and in turn foster the goodwill of the County public and taxpaying entities.

Now we come to the matter of State Aid, from the following information, you will note that this funding resource has not been consistent from year-to-year. We have experienced cutbacks, mid-year rescissions in funding, and additional measures of accountability that have increased expenses. From 2007 to 2020, aid has increased only 9.3% and far less than the cumulative inflationary increases for the same years.

Pertaining to the Miscellaneous funding streams, this funding category varies from year-to-year is difficult to predict.

So, with sensitivity to what the market will bear, limiting the tax burden for County taxpayers, and facing unreliable State funding, what are the options remaining for the College to generate resources and meet the escalation of programming/service expenses? Answer: grow enrollment and grow partnerships.

The “Answer” will be addressed in the next blog entry.

Note: Mark Dean contributed the four graphics.